PRIVATE CREDIT INCOME FUND

Ashland Private Credit Income Fund delivers accredited investors

consistent quarterly distributions through diversification within the private credit market.

PRIMARY BENEFITS FOR PASSIVE INVESTORS

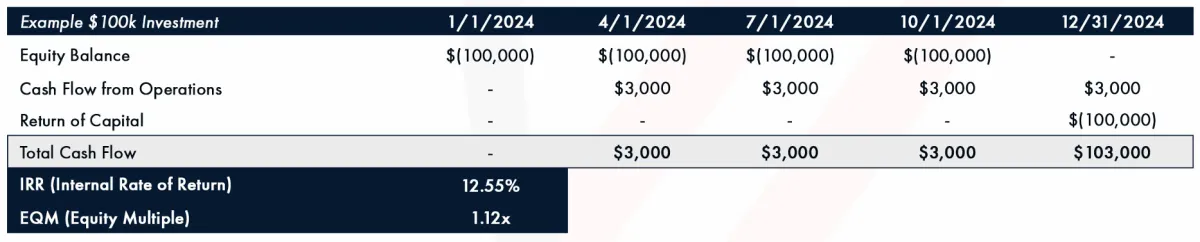

Consistent Cash Flow: 12.5% IRR distributed quarterly

First Loss Protection: Ashland is investing its own capital in a first-loss position for the fund equal to 10% of AUM, up to $2MM providing additional safety for our passive investors.

Liquidity: with only a 9 month lock-up and a 90-day redemption clause to provide liquidity and flexibility to passive investors.

Diversified Private Credit across multiple industries:

Fix/Flip Loans Secured by Single Family & Small Multifamily Real Estate

Preferred Equity for Middle-Market Multifamily

Credit to Small Operational Businesses

Reinvestment Option: Passive Investors have the ability to reinvest their distributions to benefit from compounding their returns.

* There are risks associated with investing in securities. Investing involves risk of loss including loss of principal. Past investment performance is not a guarantee or predictor of future investment performance.

ASHLAND CAPITAL'S EXPERIENCE

Ashland Capital is a multi-strategy investment firm specializing in alternative investments and asset management. Through the company’s core investment classes – multifamily, student housing, and private credit – Ashland has assembled a portfolio of well-located assets purchased below replacement cost, in addition to a portfolio of high-yield credit positions across real estate and small businesses. Leveraging decades of debt and equity investing, Ashland’s team has established themselves as highly regarded middle market investors with a knack for identifying and operating unique investment opportunities.

Our highly experienced team has a deep understanding of the real estate industry and has established a reputation as a top-performing middle market investor and lender. We have a keen eye for identifying and acquiring unique investment opportunities that others may overlook.

Ashland Capital adheres to a strategic approach characterized by flexible, opportunistic, and disciplined investment principles. Each prospective investment undergoes a meticulous underwriting process designed to comprehensively evaluate the associated risk, with the overarching objective of attaining risk-adjusted returns meeting or exceeding a 6% average cash-on-cash and a minimum internal rate of return (IRR) of 12.5%.

CONCLUSION

Entrust your capital to a firm that stands on a bedrock of over 25 years of market-leading expertise, managing assets of over $250 million. This exclusive opportunity not only offers lucrative financial returns but also affords our investors the peace of mind, knowing their investment is managed with unparalleled precision and foresight.

REACH OUT TO SCHEDULE A CALL AND

SPEAK WITH THE ASHLAND CAPITAL TEAM

IMPORTANT MESSAGE: This website is a website owned and operated by Ashland Management, LLC dba Ashland Capital Fund (“Us/We/Our/Company”). By accessing the website and any pages thereof, you agree to be bound by the Terms of Service, Privacy Policy , and Disclosures, as each may be amended from time to time. We are not a registered broker, dealer, investment advisor, investment manager or registered funding portal. Prospective investors are advised to carefully review Our private placement memorandum, operating agreement and/or partnership agreement, and subscription documents (“Offering Documents”) and to consult their legal, financial and tax advisors prior to considering any investment in the Company, one of its subsidiaries or affiliates. Sales of any securities will only be completed through the Company’s Offering Documents and will on be made available to “Accredited Investors” as defined by the Securities and Exchange Commission (“SEC”). Generally, an Accredited Investor is a natural person with a net worth of over $1 million (exclusive of residence) or income in excess of $200,000 individually or $300,000 jointly with a spouse. The securities are offered in reliance on an exemption from the registration requirements of the Securities Act of 1933, as amended, and are not required to comply with specific disclosure requirements that apply to registration under the Securities Act. Neither the SEC nor any state regulator has reviewed the merits of or given its approval to the securities, the terms of the offerings, or the accuracy or completeness of any offering materials. The securities are subject to legal restrictions on transfer and resale and investors should not assume they will be able to resell their securities. All forward-looking statements address matters that involve risks and uncertainties and investors should be able to bear the loss of their entire investment. All investors should make their own determination of whether or not to make any investment, based on their own independent evaluation and analysis. Past performance is not indicative of future returns or Fund results. Individual investment performance, examples provided and/or case studies are not indicative of overall returns of the Company. In addition, there can be no guarantee of deal flow in the future. Forward looking statements are not statements of historical fact and reflect the Company’s views and assumptions regarding future events and performance.

Copyright Ashland Management LLC 2025